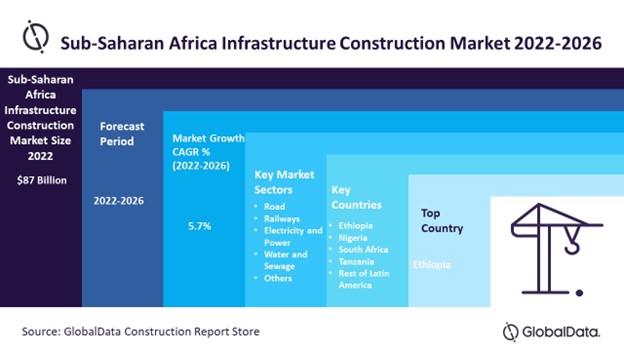

Sub-Saharan Africa infrastructure construction market size was evaluated at $87 billion in 2022, according to a new report by GlobalData Plc. The development of the regional transportation sector including rail and road network is expected to positively influence the market growth over the forecast period.

Sub-Saharan Africa Infrastructure Construction Market Outlook, 2022-2026 ($ Billion)

Sub-Saharan Africa infrastructure construction market outlook report with detailed sectors and country-wise segment analysis is available with GlobalData! Download a free sample

Sub-Saharan Africa Infrastructure Construction Market FAQs

- What was the Sub-Saharan Africa infrastructure construction market size in 2022?

The Sub-Saharan Africa infrastructure construction market size in 2022 was $87 billion. - What is the Sub-Saharan Africa infrastructure construction market growth rate during 2022-2026?

The Sub-Saharan Africa infrastructure construction market will grow at 5.7% during 2022-2026. - Which are the key sectors of the Sub-Saharan Africa infrastructure construction market?

The key sectors of the Sub-Saharan Africa infrastructure construction market are electricity and power, railway, road, water and sewage, and others. - Which are the key countries in the Sub-Saharan Africa infrastructure construction market?

Ethiopia, Nigeria, South Africa, Tanzania, and Rest of Sub-Saharan Africa are the key countries in the Sub-Saharan Africa infrastructure construction market. - Which country showcased the highest Sub-Saharan Africa infrastructure construction market growth in 2021?

Ethiopia showcased the highest share in the Sub-Saharan Africa infrastructure construction market in 2021.

For more queries related to the Sub-Saharan Africa infrastructure construction market,

buy report sample PDF right here!

Sub-Saharan Africa Infrastructure Construction Dynamics

Sub-Saharan Africa (SSA) region is expected to witness considerable growth backed by a strong project pipeline in countries including Ethiopia, Nigeria, South Africa, and Tanzania. These four countries combined account for nearly 40.0% of the overall regional pipeline in terms of value. The governments in these economies are investing on development of roads and railways. Furthermore, their initiatives to bolster transportation network developments and continue to fund public and private projects for stimulating infrastructure and economic outputs will be the major factors accentuating the Sub-Saharan Africa infrastructure construction market growth in the upcoming years.

Learn about the Sub-Saharan Africa infrastructure construction market dynamics by viewing report sample right here!

Sub-Saharan Africa Infrastructure Construction Report Highlights

- The Sub-Saharan Africa infrastructure construction market is projected to grow at a compounded annual growth rate of 5.7% over the forecast period. The region growth is fueled by the rising public investment to develop a world class roadway and railway infrastructure.

- In 2021, the road category dominated the overall sectoral growth with a share of around 29.0%. The roads domain in the region witnessed rise in public spending for construction, maintenance, and rehabilitation of existing network in 2021.

- The others category including airports, seaports, marine, and inland water projects accounted for the second-largest share in 2021. This sector is poised to depict an annual average growth rate of 5.7% from 2023 to 2026, primarily backed public spending of more than $25.7 billion over the coming years.

- The electricity and power segment is projected to showcase the highest compounded annual growth rate of nearly 6.4% over the forecast period. The increasing shift towards renewable sources of energy due to increasing energy prices is expected to drive the market positively.

- The railway sector in the Sub-Saharan region is expected to witness a steady demand with second highest compounded annual growth rate over the forecast period. The development in this sector is bolstered by the continuous spending on projects to stimulate infrastructure and economic outputs.

- Ethiopia will remain a dominant regional force in 2021 with an overall share of more than 26.0%. The country is poised to observe a highest compounded annual growth rate over the forecast period.

- Nigeria is estimated to account for the second-largest regional share in 2021. However, the market growth is anticipated to remain slowe in comparison to its regional counterparts owing to the surging inflation and high construction material prices.

- Tanzania with a small regional share is expected to witness second highest compounded annual growth rate over the forecast period. The government of Tanzania is undertaking strong measures to develop the country’s railway and water infrastructure. These measures are projected to generate steady public investments and thus, positively aid the segmental growth over the near future.

Request a sample pdf for additional Sub-Saharan Africa infrastructure construction market dynamics

Sub-Saharan Africa Infrastructure Construction Market Scope

GlobalData Plc has segmented the Sub-Saharan Africa infrastructure construction market report by sectors and countries:

Sub-Saharan Africa Infrastructure Construction Sectors Outlook (Value, $ Billion, 2016-2026)

- Electricity and Power

- Railway

- Road

- Water and Sewage

- Others

Sub-Saharan Africa Infrastructure Construction Countries Outlook (Value, $ Billion, 2016-2026)

- Ethiopia

- Nigeria

- South Africa

- Tanzania

- Rest of Sub-Saharan Africa

Looking for a more specific Sub-Saharan Africa infrastructure construction market scope coverage, grab your exclusive sample report copy!

Related Reports

- Infrastructure Market Size, Trends and Growth Forecast by Key Regions and Countries, 2021-2026

- Kenya Construction Market Size, Trends and Forecasts by Sector – Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential Market Analysis, 2022-2026

- South Africa Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecasts, 2022-2026

Table of Contents

1 Overview

2 Sector Overviews

2.1 Railways

2.2 Roads

2.3 Electricity and Power

2.4 Water and Sewage

2.5 Others

3 Project Pipelines

3.1 All Infrastructure Projects

3.1.1 Railway Projects

3.1.2 Road Projects

3.1.3 Electricity and Power Projects

3.1.4 Water and Sewage Projects

3.1.5 Other Projects

4 Sub-Saharan Africa Infrastructure Construction Regional Trends

4.1 Sub-Saharan Africa Infrastructure Construction Market Data

4.1.1 Ethiopia Infrastructure Construction Market Data

4.1.2 Nigeria Infrastructure Construction Market Data

4.1.3 South Africa Infrastructure Construction Market Data

4.1.4 Tanzania Infrastructure Construction Market Data

4.1.5 Rest of Sub-Saharan Africa Infrastructure Construction Market Data

5 Research Methodology

5.1 Introduction

5.2 Research Methodology Steps

5.2.1 Data Collection and Consolidation

5.2.2 Modelling and Estimation

5.2.3 Forecasting and Validation

About us

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.

Contact Information:

GlobalData Mark Jephcott Head of PR EMEA [email protected] cc: [email protected] +44 (0)207 936 6400

Tags:

Reportedtimes, Extended Distribution, iCN Internal Distribution, Research Newswire, English